Las Vegas Businesses Ditch Credit Card Fees for Bitcoin Payments

Las Vegas Valley businesses, from restaurant chains to small juice bars, are embracing Bitcoin payments as mainstream adoption accelerates, with companies avoiding credit card processing fees averaging 2.5% to 3.5% while tapping into a growing customer base actively seeking crypto-friendly merchants.

The shift follows Square’s November 2025 decision to enable roughly 4 million U.S. merchants to accept Bitcoin payments with zero processing fees through 2026.

According to Fox5Vegas, at Cane Juice Bar and Cafe on Rainbow near Windmill, district manager Tyler Peterson serves fresh-pressed sugar cane juice that customers can pay for with cash, card, or Bitcoin after eight months of crypto implementation.

“Bitcoin is getting very popular with mainstream people, not just the people that are actually into things like cryptocurrencies,” Peterson said, noting the payment option helps the business “move forward” while attracting new customers who specifically seek Bitcoin-accepting locations.

Small Business Growth Through Bitcoin Maps

Peterson confirmed customers who normally wouldn’t know about his shop come in specifically to use Bitcoin, with calls and inquiries arriving regularly.

“So actually some customers we have generated off of accepting Bitcoin,” Peterson said. “That Bitcoin map is helping us out a lot.”

Consumers can locate Bitcoin-accepting businesses through dedicated Bitcoin maps or Cash App’s directory feature, creating organic discovery channels for merchants willing to accept crypto payments.

Jeremy Querci, a Bitcoin consultant with Sovreign, explained that businesses accepting Bitcoin now range from medical practices to juice bars to children’s play places, with payment processing requiring just a few taps on a phone.

“At the time of checkout, you say you want to pay in Bitcoin and the business can bring up a QR code that you scan with your phone with any Bitcoin app,” Querci said, while Peterson asserted the technology will become progressively easier as “it’s the future.”

National Chains Lead Corporate Bitcoin Adoption

The momentum extends beyond small businesses into major restaurant chains, with Steak ‘n Shake announcing this week plans to pay all hourly employees at company-operated restaurants a Bitcoin bonus of $0.21 for every hour worked starting March 1, with funds accessible after a two-year vesting period.

CEO Will Reeves positioned the move as part of the 91-year-old burger chain’s transformation into “a real bitcoin company, putting sound money into the hands of working Americans.“

Lightning Network payments enabled across all U.S. Steak ‘n Shake locations in mid-May 2025 brought transaction fee savings of nearly 50% compared with credit cards, alongside roughly 15% increases in same-store sales in the months following launch.

The rollout received public backing from Jack Dorsey, who enthusiastically endorsed the chain’s Bitcoin adoption plans when the company first polled followers about accepting crypto.

Infrastructure Advances Enable Mainstream Payments

Cash App rolled out Bitcoin Lightning payments and stablecoin transfers in November 2025, allowing eligible users to pay over the Lightning Network in seconds with no fee using either BTC or USD balances after scanning a Lightning QR code.

The app introduced Bitcoin Map, an in-app directory that helps customers find nearby Square merchants and other businesses accepting Bitcoin, enabling users to locate stores, get directions, and pay directly over Lightning at checkout.

Just yesterday, crypto payments firm Mercuryo partnered with Visa to enable near-real-time conversion of digital assets into fiat currency, allowing users to send proceeds directly to Visa debit and credit cards via Visa Direct.

“This partnership with Visa will further enhance Mercuryo’s ability to deliver a fast, low-cost user experience,” said Mercuryo co-founder and CEO Petr Kozyakov, noting the integration reduces friction historically associated with moving funds across borders or cashing out digital assets.

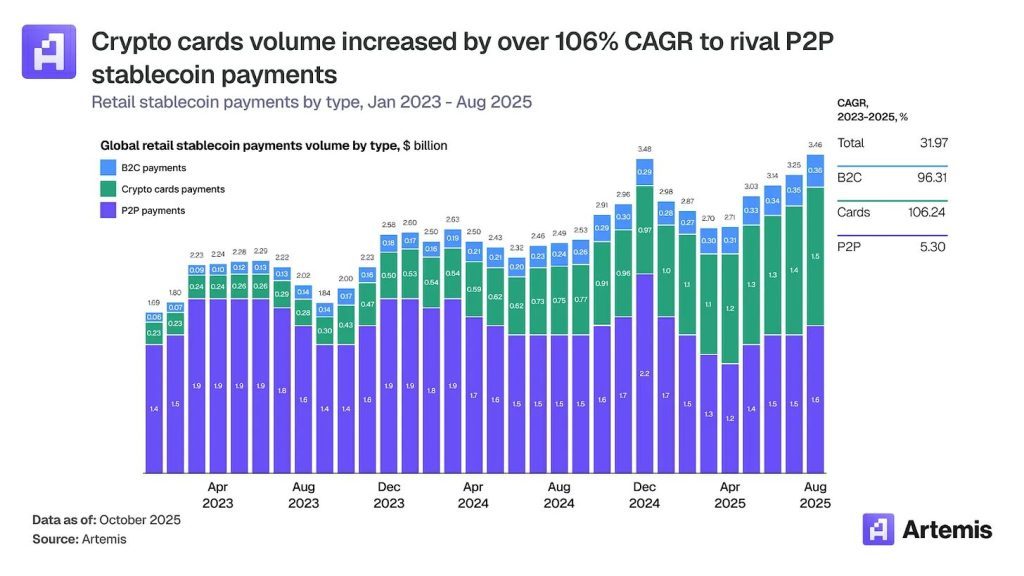

The corporate adoption mirrors explosive growth across the broader crypto payments landscape, with crypto card volumes surging from roughly $100 million monthly in early 2023 to over $1.5 billion by late 2025, representing a 106% compound annual growth rate, according to Artemis Analytics.

Annualized volumes now exceed $18 billion, while traditional peer-to-peer stablecoin transfers grew just 5% to $19 billion over the same period.

At the time of publication, Bitcoin is trading around $89,500, down roughly 5% over the previous week, as Bitcoin spot ETFs experienced steep outflows totaling $1.62 billion across four trading days amid compressed yields on basis trades that dropped below 5% from around 17% a year ago.

The post Las Vegas Businesses Ditch Credit Card Fees for Bitcoin Payments appeared first on Cryptonews.

Steak ‘n Shake announces Bitcoin hourly bonus for workers starting March 1, expanding its treasury strategy that contributed to 15% same-store sales growth.

Steak ‘n Shake announces Bitcoin hourly bonus for workers starting March 1, expanding its treasury strategy that contributed to 15% same-store sales growth.