Bitcoin Price Prediction: BTC Slips to $83K but These Behind-the-Scenes Signals Are Turning Heads

Bitcoin slipped to around $85,289, down 4.75% on Thursday, extending short-term volatility across crypto markets. Yet beneath the price pullback, a series of structural developments point to longer-term forces that could reshape Bitcoin’s supply-demand balance and investor confidence.

Rather than signaling a breakdown, the move reflects a market digesting regulatory shifts, new Bitcoin-native DeFi activity, and renewed corporate accumulation. For long-term holders, these dynamics matter far more than a single red candle.

Senate Agriculture Committee Advances Crypto Market Structure Bill

Regulatory efforts are picking up speed. The US Senate Agriculture Committee has moved a key crypto market structure bill forward after a close 12-11 vote, sending it to the full Senate. Although the vote was split by party, this step brings the industry closer to clearer rules for digital assets.

Democrats proposed changes to address potential conflicts with political crypto projects and to prevent taxpayer-funded bailouts for intermediaries. These proposals were rejected, as Republicans said any remaining concerns could be handled later. Now, focus turns to the Senate Banking Committee, which has postponed its own review.

Clearer rules will not remove volatility right away, but they are important for institutions. When regulations are certain, compliance risks go down and capital allocation decisions become easier. This is key for long-term Bitcoin adoption.

Citrea Rekindles the Bitcoin Block Space Debate

Bitcoin is changing at the protocol level. Citrea, which is supported by Founders Fund and Galaxy Ventures, has launched its Bitcoin ZK-rollup mainnet. This platform offers decentralized trading, BTC-backed lending, structured products, and a native stablecoin called ctUSD.

Citrea wants to make idle Bitcoin more useful by turning it into active liquidity, with a goal of reaching $50 million in value in the next few weeks. Supporters say that as block rewards decrease, rollup activity could increase miner fee revenue and help secure Bitcoin in the long run.

Metaplanet Approved a $137 Million International Fundraising Plan

Metaplanet, a company listed in Tokyo, has approved a $137 million international fundraising plan to buy more Bitcoin and reduce its debt. The company will issue 24.5 million new shares to raise about $78 million right away. It could also raise another $56 million if it uses its stock acquisition rights, or warrants, over the next year.

Strategy director Dylan LeClair said the sale will be private and offered to foreign investors, with a structure designed to raise funds while keeping dilution low.

Metaplanet says it will mainly use the funds to buy more Bitcoin, expand its Bitcoin revenue business, and pay down some of its current debt to free up borrowing capacity for future projects.

The company continues to call itself a “Bitcoin Treasury Company” and reportedly owns 35,102 BTC, worth over $3 billion.

Increased corporate purchases boost institutional demand and decrease circulating supply both of which are generally positive for BTC.

Bitcoin Price Prediction: BTC Tests $83K Support as Descending Channel Nears Decision Point

Bitcoin’s outlook is still bearish, with the price trading around $83,800. After falling below a clear descending channel on the 4-hour chart, the correction has continued. Since peaking near $97,500 in January, BTC has dropped into a demand zone between $84,000 and $85,500, an area where it consolidated in late December.

Momentum is still weak. Bitcoin keeps making lower highs, limited by a downward trendline. A recent run of strong red candles looks like a three black crows pattern, which shows ongoing selling pressure. The price is also staying below the 50- and 100-period EMAs near $89,500 to $90,500, which is limiting any rebounds.

However, the downward momentum might be easing. The RSI is now in the mid-20s, which is very oversold and often comes before the price stabilizes. Long lower wicks near $83,300 to $83,800 show that some buyers are stepping in at these levels.

If BTC stays above $83,000, it could try to bounce back toward $86,100 and $88,400. If it falls below $83,000, the price might drop to $81,600, and possibly even to $79,800.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

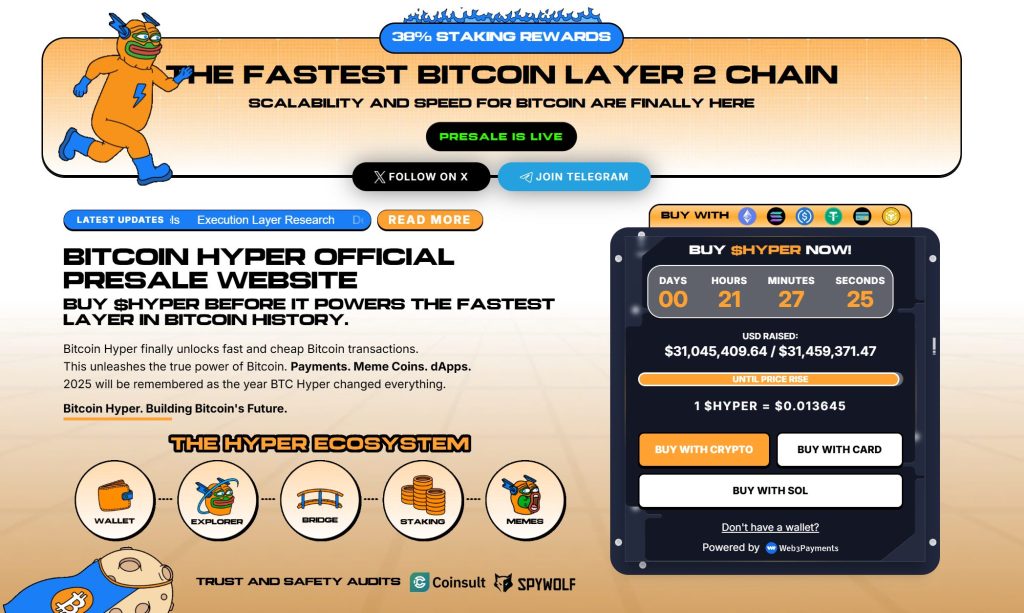

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31 million, with tokens priced at just $0.013645 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: BTC Slips to $83K but These Behind-the-Scenes Signals Are Turning Heads appeared first on Cryptonews.

BIG: U.S. Senate Agriculture Committee just advanced the crypto market structure bill

BIG: U.S. Senate Agriculture Committee just advanced the crypto market structure bill  Metaplanet to raise $137 million to buy more Bitcoin.

Metaplanet to raise $137 million to buy more Bitcoin.